![]()

A Slow Start and a Sudden Surge

The Engines of Growth: Who Powered India’s Comeback?

Every great journey has its heroes. In India’s economic story for FY25, several sectors played starring roles. Here’s a snapshot of the main drivers:

Construction

The construction sector became the backbone of India’s recovery, growing by 9.4% for the year and an impressive 10.8% in Q4. Massive infrastructure projects and a real estate revival created jobs and spurred investment.

Public Administration and Defence

Government spending surged, with this sector growing by 8.9% for the year, providing stability amid global uncertainty.

Financial, Real Estate, and Professional Services

Expanding by 7.2% annually, these sectors showcased India’s growing prowess in services and finance.

Agriculture

After a slow start, agriculture bounced back, growing by about 4.4% for the year and 5% in the final quarter. A good monsoon and strong rural demand turned this sector from a laggard to a leader.

Private Consumption and Investment

Indian households and businesses stepped up, with private consumption rising by 7.2% and investment increasing by 7.1% for the year. This was the heartbeat of India’s growth people buying, building, and believing in the future.

Why Did Q4 Surprise Everyone?

The final quarter of FY25 was like the climax of a blockbuster movie,full of twists and triumphs. While many predicted a slowdown, India delivered a blockbuster performance with 7.4% growth. What fueled this surge?

- Industrial Boom: Construction and manufacturing came alive, driven by big projects and real estate demand.

- Government Push: Public spending, especially in administration and defense, gave the economy a much-needed boost.

- Rural Revival: Better farm output and stronger rural demand helped offset global shocks.

- Confidence Returns: People and businesses started spending and investing again, fueling momentum.

Here’s how India’s GDP growth trended each quarter:

India’s Place in the World

The Road Ahead: Challenges and Opportunities

Every story has its challenges, and India’s economic journey is no different. Here are the hurdles that could shape the next chapters:

- Global Trade Troubles: Ongoing tensions and tariffs could hurt exports and investment.

- Fiscal Pressure: High government spending needs to be matched by strong revenue growth.

- Monsoon Magic or Misery: Agriculture depends on the rains, and a bad monsoon can hurt rural demand.

- Private Investment Caution: While public investment is strong, private companies are still careful.

- Manufacturing Headwinds: Manufacturing growth has been subdued, raising concerns about jobs and exports.

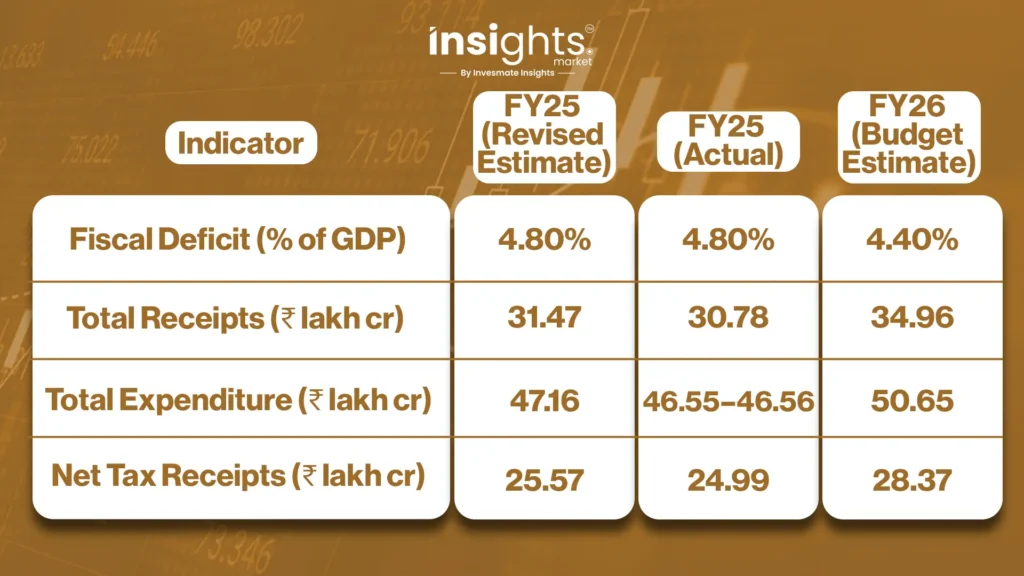

For readers interested in government finances, here’s a quick snapshot:

India’s Growth is Strong, But Is It Sustainable?

India’s GDP grew at a robust 7.4% in Q4, beating most forecasts and marking the fastest pace in the year. But is this growth truly as strong as it seems?

Much of the momentum is coming from government-led infrastructure spending, especially in construction and gross fixed capital formation (GFCF)—rather than from private consumption or core sectors. While the Purchasing Managers’ Index (PMI) for manufacturing shows expansion, the actual GDP data reveals only moderate manufacturing growth (around 4.8%). This gap between business sentiment and real output suggests that while optimism is high, the underlying strength may not be as solid as it appears.

Key sectors like manufacturing (4.8%), mining (2.5%), utilities (5.4%), and trade & hotels (6%) indicate India is growing, but not at a pace strong enough to make India recession-proof. If the US or other major economies enter a slowdown, India’s service exports and financial sector tightly linked to global demand could feel the impact first.

India might be insulated from global shocks, but it is not invincible. The PMI index is growing, which shows the manufacturing sector is picking up pace, but this does not guarantee complete immunity from external risks.

The Bright Spots: Inflation and Monetary Policy

Retail inflation dropped to a near six-year low of 3.16% in April 2025. Combined with a favorable monsoon forecast, this could open the door for the Reserve Bank of India (RBI) to consider a rate cut in June, further aiding growth. The RBI had already cut the repo rate by 25 basis points in February 2025, signaling its readiness to support the economy.

Read Also: RBI’s Repo Rate Cut: A Game-Changer for Borrowers and Markets

The Takeaway

FY25 was a tale of two halves a slow start, a powerful finish, and a clear message to the world: even when the global winds blow strong, India’s economy knows how to stay on track. With a $3.9 trillion economy and the promise of overtaking Japan soon, the next chapter looks set to be even more exciting.

“This pick-up was supported by robust domestic demand, strong public infrastructure investment, and shifting global supply chains that increasingly favour India amid geopolitical reorientations.” — Assocham President Sanjay Nayar

Read Also: Indian Stock Market Reaction To Wars, Conflicts, And Terror Attacks: A Look Since 1990

India’s ability to withstand global shocks and deliver strong growth in FY25 is a testament to its resilience. As the world watches, India’s economic story unfolds full of challenges, opportunities, and the promise of a brighter future.

FAQs

Key challenges include ongoing global trade tensions, fiscal pressures from high government spending, reliance on monsoon rains for agricultural growth, cautious private investment, and subdued manufacturing performance.